Today, LMCU has above $12 billion in assets, and It is the biggest economic institution headquartered in West Michigan. It is the seventeenth biggest credit union while in the country, according to asset dimensions.

Similar: Listed here’s a scientific technique to build your wealth now Understand that creating bi-weekly payments means you will fork out less in interest around the program of your respective loan term lowering the overall cost of one's loan. Do that Loan Repayment Calculator to determine how the figures perform on your situation.

If you end up picking to pay for on a bi-weekly basis, it can be as should you be adding a thirteenth payment to your standard 12 payments. You can hardly sense a distinction between a regular, month to month payment agenda along with a bi-weekly payment program – except, certainly, that you'll be creating two payments per month in place of a single.

We thoroughly fact-Check out and assessment all information for accuracy. We aim to create corrections on any faults the moment we're mindful of them.

Navy Federal has quite a bit going for it. Other than its big selection of term lengths and loan quantities from which to choose, there isn't any origination fees and in some cases a 0.25% rate price reduction along with the presently superb rates if you use autopay.

LMCU also offers competitive APRs and doesn’t cost origination expenses, helping to maintain your borrowing costs down. Its bare minimum needed credit rating of 620 makes its loans obtainable to borrowers with truthful credit.

Risk is usually assessed every time a lender appears at a possible borrower's credit score, And that's why it is vital to have a fantastic one in order to qualify for the top loans.

Chris Jennings is usually a writer and editor with more than 7 decades of knowledge in Loan Mortgage the personal finance and mortgage space.

Every payment you make on a credit-builder loan is reported to credit agencies, and as time passes the payments can help boost a foul score or allow you to create a credit score in the event you don’t have 1.

Amy is an ACA and also the CEO and founder of OnPoint Understanding, a fiscal education firm providing teaching to fiscal gurus. She has almost two decades of practical experience from the economic market and as being a money instructor for sector experts and people today.

The lender could have invested the resources all through that period of time rather than supplying a loan, which might have generated earnings with the asset. The difference between the full repayment sum and the initial loan is the interest billed.

Such a interest isn’t popular in common lending, however, you might find very simple interest on payday loans, auto title loans and installment Get more info loans. Some private loans or sure auto loans may use straightforward interest, but this is exceptional.

This tends to make borrowing costlier on the whole, reducing the desire for income and cooling off a incredibly hot economic climate. Reducing interest rates, on the other hand, will make revenue much easier to borrow, stimulating paying and financial investment.

Down below is more details about loans, the repayment course of action, and some recommendations on very best tactics to assist you to lower your expenses and keep away from evident issues through the loan repayment system.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Jeremy Miller Then & Now!

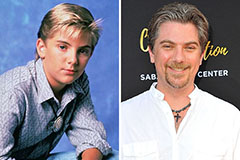

Jeremy Miller Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!